With a greater international focus on tax transparency and the battle against tax evasion and other financial crimes, the requirement of identifying the Ultimate Beneficial Owner has gained traction around the world.

Furthermore, the Financial Action Task Force’s (‘FATF’) advice to the OECD Global Forum on Transparency on anti-money laundering (AML) and counter-terrorist financing (CFT) measures has prompted new rules in several countries.

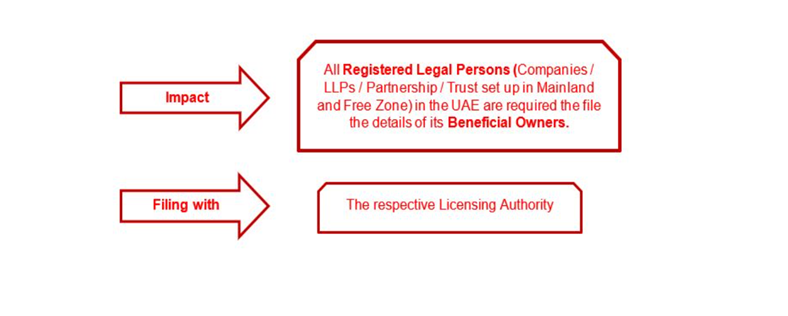

In this regard, on August 24, 2020, the United Arab Emirates (UAE) enacted Cabinet Decision No. 58 of 2020 on Regulating Beneficial Owner Procedures (the Regulations).

According to the Regulation, the existing Legal Person must file the details of the Ultimate Beneficial Owner (UBO) within 60 days of the decision’s promulgation, or by October 27, 2020.

Each Licensing Authority, on the other hand, has set its own deadline for complying with the Beneficial Owner Procedure Regulations. As a result, in order to assure compliance, the licencing body with whom it is registered must impose a deadline.

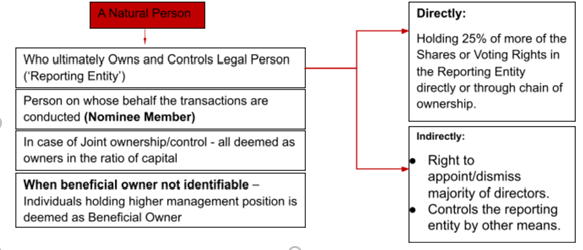

Who is an Ultimate Beneficial Owner?

What information is needed to maintain the Register of Beneficial Owners up to date?

Though each licencing Authority will have its own list of details, the Register of Beneficial Owners will generally include the following information for each Beneficial Owner:

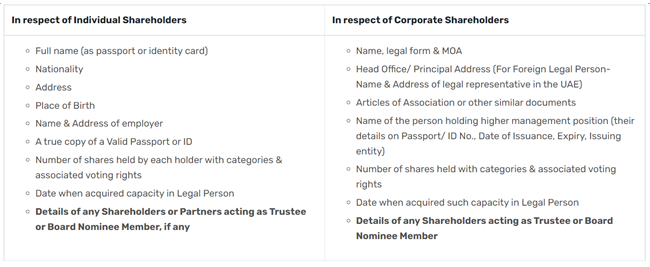

What information is needed to keep the Register of Shareholders or Partners up to date?

The following are the details that must be kept in respect of the reporting entity’s shareholders, as listed in the Regulation. Each licencing, however, has provided its own list of details and format for submitting shareholder information.

What can we do to assist?

Our experienced, devoted, and knowledgeable team will assist you in the following areas:-

FAQ

What is the distinction between the beneficial owner and the ultimate beneficial owner?

A Beneficial Owner is a person who owns and manages the legal entity in the long run. Cabinet Decision No. 58 of 2020 defines the Beneficial Owner. In business, the terms Ultimate Beneficial Owner and Beneficial Owner are frequently interchanged since the goal is to identify the legal person’s ultimate owner and/or controller.

Is there any type of company that is exempt from filing UBO information?

The terms of this Regulation do not apply to entities held entirely by the local or federal government, their subsidiaries, or the Financial Free Zone (DIFC and ADGM) companies.

What if government entities hold a portion of the corporation (15 percent, 50 percent, or 75 percent)? Will they be excused from disclosing information on Beneficial Owners?

Only if the company is entirely controlled by the local or federal government will it be excused from filing Beneficial Owner information. If the company is owned in part by the municipal or federal government, it must adhere to all of the conditions of this regulation. s.

Will the Regulation apply to Co X in the UAE if it is owned by a company outside of the UAE? In the Beneficial Owner Register, whose name will appear?

All legal persons in the UAE shall be subject to the regulation. As a result, Co. X will be required to keep and submit the Beneficial Owners and Shareholders Registers.

Co X will be required to get the identities of Beneficial Owners of the Company who are located outside of the UAE and report them to the Beneficial Owner Register.

What are the consequences of non-compliance?

The UAE Ministry of Economy may impose sanctions on enterprises found to be in violation of the Regulation. The administrative punishments list has yet to be released.

Who is the ultimate beneficial owner of a business?

Beneficial owner, as defined in Cabinet Decision No. 58 of 2020, is a natural person who controls the legal person either directly (holding 25% or more of the shares or voting rights directly or through the chain of ownership) or indirectly (right to appoint/fire majority of directors or by any other means, such as through POA). If no single person can be recognised as having direct or indirect ownership or control of the legal business, those in higher managerial positions are presumed to be the beneficial owners.

BackWe are purely a marketing company specializing in lead generation via digital marketing for Accounting and book Keeping industry and we then pass on these leads to relevant Accounting Firms as customer referrals and our role starts and finish as soon as customer details are handed over to accounting firms in Dubai UAE. The entire purpose for this website/portal is lead generation.

Copyright © 2021, Accountant Dubai, All Rights Reserved.