The Tax Residency Certificate (TRC), also known as the Tax Domicile Certificate, is a government-issued document issued by the UAE’s tax authorities. The Ministry of Finance (‘MoF’) issued it till November 11, 2020. According to Cabinet Resolution No. (65) of 2020, the Federal Tax Authorities (‘FTA’) will issue Tax Residency Certificates / Tax Domicile Certificates on an application made by a UAE resident (individual or incorporated organisation) beginning November 14, 2020.

In the United Arab Emirates, a Tax Residency Certificate or a Tax Domicile Certificate is required:

In the UAE, who is eligible for a Tax Residency or Tax Domicile Certificate?

From 14 November 2020, the FTA will issue the Tax Residency Certificate or Tax Domicile Certificate to qualifying government agencies, other legal persons, and people in the UAE. Residents and Mainland / Free Zone entities in the UAE are entitled to apply for a Tax Residency Certificate or Tax Domicile Certificate in the UAE, according to our knowledge. Because offshore companies may not have a physical presence in the UAE, they may be ineligible to apply for TRC.

What Are the Advantages of Getting a Tax Residency Certificate?

The uncontested document to prove that an entity is a resident of a Tax Residency Certificate or Tax Domicile Certificate issuing jurisdiction is a Tax Residency Certificate or Tax Domicile Certificate issued by a Statutory Authority (in UAE – FTA). Tax authorities all over the world recognise the Tax Residency Certificate or Tax Domicile Certificate as a trustworthy document for proving an entity’s residency.

This enables the entity to defend the applicability of DTAA provisions. Entities can use the provisions of the DTAA to plan their taxes and restructure their businesses/transactions. Businesses can develop tax-efficient structures thanks to favourable provisions in the Withholding Tax and Permanent Establishment Acts.

The UAE signed 115 DTAAs with the majority of its trading partners in order to promote its development goals. If the applicant’s residency status is certain, there are numerous chances for tax planning.

The Tax Residency Certificate or Tax Domicile Certificate’s validity

The Tax Residency Certificate or Tax Domicile Certificate has a one-year validity period from the date of issue. The Tax Residency Certificate or Tax Domicile Certificate can only be used for one country at a time by corporations and individuals. It is also possible to apply for several certificates if necessary.

Obtaining a Tax Residency or Tax Domicile Certificate in the United Arab Emirates

In order to obtain a Tax Residency Certificate or Tax Domicile Certificate in the UAE, you must first create an account on the ministry’s website. This necessitates the acquisition of the following items:

Individually:

Individuals who have lived and worked in the UAE for at least 183 days can apply for a Tax Residency Certificate or a Tax Domicile Certificate.

Documents Needed to Get a Tax Residency or Tax Domicile Certificate

For Legal Persons: A legal person who has been functioning in the country for at least one year can apply for a Tax Residency or Tax Domicile Certificate.

Required Documents:

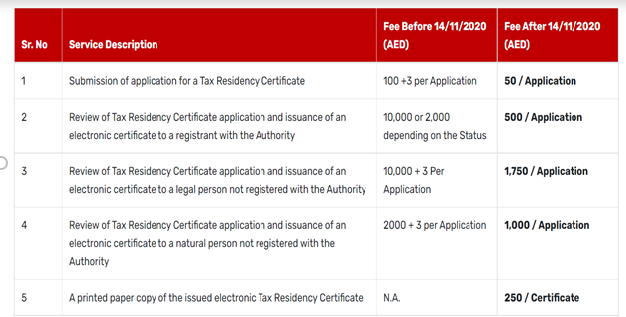

FTA charges the following fees for issuing a Tax Residency Certificate / Tax Domicile Certificate:

Cabinet Resolution No. (65) of 2020 establishes the following fees for applying for and receiving a Tax Residency Certificate / Tax Domicile Certificate:

Services we provide: Our knowledgeable and experienced personnel can assist and guide you through the process of verifying the relevant papers and getting the Tax Residency Certificate or Tax Domicile Certificate.

FAQ

In the United Arab Emirates, who issues tax residency certificates?

The Federal Tax Authority (‘FTA’) issues Tax Residency Certificates / Tax Domicile Certificates.

What is the procedure for obtaining a tax residency certificate in Dubai?

An application must be submitted through the FTA’s online service portal (https://trc.tax.gov.ae/TRC Th/) to get a tax residency certificate in Dubai or for any other qualifying person (individual or corporate) in the UAE.

What is tax residence in the United Arab Emirates?

Tax Residency Certificate (‘TRC’), also known as Tax Domicile Certificate, is an official document issued by government authorities, in this case the Federal Tax Authority of the United Arab Emirates, to confirm that the applicant is a tax resident of the United Arab Emirates, as defined by the Tax Treaty, and thus eligible for the benefits of the Tax Treaty between the UAE and the corresponding country.

BackWe are purely a marketing company specializing in lead generation via digital marketing for Accounting and book Keeping industry and we then pass on these leads to relevant Accounting Firms as customer referrals and our role starts and finish as soon as customer details are handed over to accounting firms in Dubai UAE. The entire purpose for this website/portal is lead generation.

Copyright © 2021, Accountant Dubai, All Rights Reserved.